The huge yearly losses in revenue in the maritime sector by the insurance industry is beginning to generate fresh apprehension among members of the Nigerian Insurers Association (NIA), triggering a move to address the capital flight challenge in the sector.

The NIA, at a forum in Lagos, said consultation is ongoing with the National Insurance Commission (NAICOM), Nigerian Shippers’ Council and other stakeholders in the maritime value chain to tackle the challenge.

Other stakeholders being consulted are shippers/ importers, clearing agents, truck owners, the Guild of Marine Surveyors, tracking firms among others.

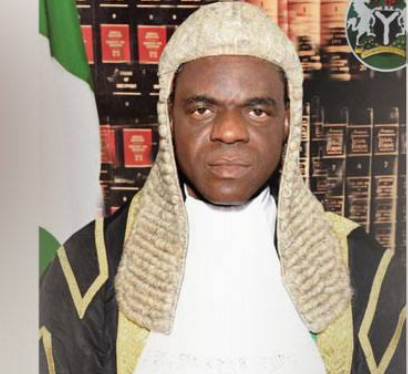

“This will be a risk management substitute for container deposits being made by the importer to the shipping firms, thereby rejecting capital flight from the country,” the Chairman of NIA, Ganiyu Musa, said.

On the NEXIM Bank Export Insurance project, Musa said the association, with the help of her team of actuaries, was discussing with NEXIM Bank, MNK Re Limited and the Guild of Marine Surveyors with a view to developing a cover for export credit guarantee insurance and political risks for banks and exporters.

According to him, the association is collaborating with relevant agencies towards enforcement and validation of the insurances made mandatory by law.

He said the industry was also working with Lagos State government in the area of enforcement and validation of genuine compulsory third-party insurance.

“The association is in discussion with Lagos State Building Control Agency (LASBCA) with a view to using the Nigerian Insurance Industry Database (NIID) verification platform for enforcement, verification and validation of genuine compulsory Buildings Under Construction Insurance made mandatory by Law through Insurance Act 2003 (SECTION 64), and Lagos State Urban and Regional Planning and Development (Amendment) Law 2019.

“The association is collaborating with Lagos Safety Commission (LSC), Nigerian Council of Registered Insurance Brokers (NCRIB) and Courteville on the implementation, enforcement and validation of genuine compulsory Occupiers Liability Insurance made mandatory by law.”