Why is Nigeria’s anti-corruption war largely ineffective? The leadership of two institutions at the vanguard of the crusade gave concerning insight into the operational challenges they face, which undermine their effectiveness.

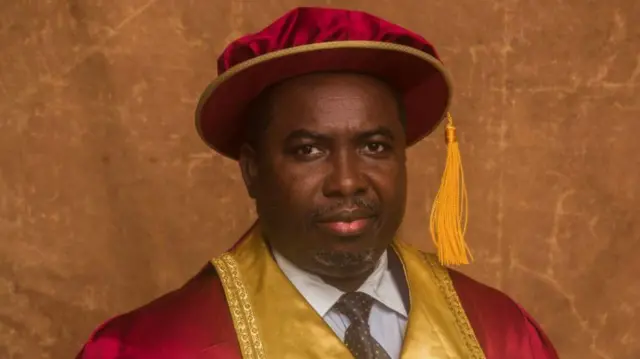

Chairman of the Independent Corrupt Practices and Other Related Offences Commission (ICPC) Dr Musa Adamu Aliyu (SAN), and Executive Chairman of the Economic and Financial Crimes Commission (EFCC) Olanipekun Olukoyede, painted a picture of hampering underfunding during their 2026 budget defence appearance before the Senate Committee on Anti-Corruption and Financial Crimes.

Aliyu made alarming revelations: “Our major challenge remains funding. Prosecutors sometimes use their personal money to go to court, and several investigations could not proceed as scheduled because we could not pay service providers.”

He added: “Only N2.2 billion out of the N7.82 billion overhead allocation was released, representing 28 per cent. For capital expenditure, only N449 million out of N7.3 billion approved was released, and that came late, on November 28, 2025.”

The ICPC boss said the commission received 1,107 petitions, assigned 700 for investigation and completed 250 investigations, blaming the gap on funding and personnel shortages. He explained that “Some cases take two to five years to conclude,” adding, “Funding constraints affect travel, document retrieval, forensic tools and manpower. We have to prioritise cases based on available resources.”

Aliyu argued that “With adequate funding, infrastructure and manpower, the number of completed investigations will increase.” He also said, “Some lawyers even pay from their own pockets to prosecute cases.”

He described staff morale as “very low,” and their welfare as “poor,” noting that they investigate “highly sensitive and risky cases.”

“Without adequate funding, there is no way this agency can effectively fight corruption. It will also affect Nigeria’s image globally,” he concluded.

Operating under significant budgetary constraints, the ICPC, according to Aliyu, successfully recovered N33.1 billion in cash and $1.98 million, alongside substantial non-cash assets including land, vehicles, and businesses. On the litigation front, the agency filed 72 new cases, secured 36 convictions, and is currently managing 453 active prosecutions.

EFCC boss Olukoyede made similar complaints, saying poor funding could hamper the commission’s operations this year. He said only 74 per cent of the commission’s total appropriation was released, and capital releases were limited to 50 per cent last year.

“Most of our contractors have not been serviced, including licence providers. This will pose a major problem for us going forward because we need those licences to continue our work,” he stated.

The EFCC’s mid-term report covering the two-year period from October 2023 to September 2025 under Olukoyede’s leadership is a testimony to his drive. The report released in October 2025 highlighted recoveries, convictions, economic impact, investment of recovered funds, high-profile prosecutions, and institutional reforms.

The commission recovered over N566.3 billion, $411.5 million, £71,306, and €182,877. It secured the final forfeiture of 1,502 real estate assets, including a large estate of 753 duplexes in Abuja and Nok University, which has since been converted to a federal university.

Also, the commission secured 7,503 convictions and filed 10,525 cases in court from over 19,000 petitions received and 29,000 cases investigated.

Its crackdown on currency racketeering, Naira abuse, and cryptocurrency fraud was a significant factor in reducing pressure on the national currency and supporting the stabilisation efforts of the Central Bank of Nigeria (CBN).

Additionally, N100 billion from the recovered funds was invested into the Federal Government’s Students Loan Scheme and Consumer Credit Scheme.

Public interest in the commission’s high-profile prosecutions grew as it revived and prosecuted several long-standing cases involving prominent Nigerians, including former governors Willie Obiano, Abdulfatah Ahmed, Darius Ishaku, Theodore Orji, Yahaya Bello, and former CBN Governor Godwin Emefiele.

According to an investigative report published in October 2023, Olukoyede inherited “no fewer than 25 high-profile corruption cases involving former governors, ministers and senators.” The cases were said to involve “not less than N772.2bn and another $2.2bn, alleged to have gone missing through money laundering, fund diversion and misappropriation.”

The commission faced serious questions concerning its internal system, making internal cleansing inevitable. There was a need to provide answers to the questions. Internal reforms under Olukoyede included the dismissal of 55 staff for misconduct and the creation of new directorates for Fraud Risk Assessment and Control, Digital Transformation and Innovation, and International Asset Tracing and Recovery.

Apart from deepening ties with international bodies like the FBI, UK NCA, and INTERPOL, which aided in recovering assets abroad, the commission launched EFCC Radio 97.3 FM to raise public awareness about financial crimes and integrity.

This report is not only useful in assessing the EFCC’s performance in the Olukoyede era but also gives insight into the personal dynamism he has stamped on the commission. His performance against the background of “chronic underfunding” is remarkable.

President Tinubu, in a congratulatory message on his birthday last year, October 14, said Olukoyede has demonstrated professionalism and courage in the discharge of his duties, reinforcing the EFCC’s mission to rid the nation of economic and financial crimes.

The President also acknowledged his commitment to the fight against corruption, transparency in governance, and institutional reforms within Nigeria’s anti-graft framework.

However, there is no question that the country’s anti-corruption commissions need adequate funding to be maximally effective. Imagine what these agencies could do if the authorities actually released 100 per cent of their budgets!

The ICPC requested N25.8 billion for 2026, but the executive proposal actually reduced their allocation, cutting N4.7bn from overhead and N2.2bn from capital. The EFCC has proposed a total budget of N88 billion for 2026 (including N22.8bn for capital).

Notably, members of the Senate Committee on Anti-Corruption and Financial Crimes expressed concern regarding the “chronic underfunding” of the agencies, and promised to interact with the Appropriations Committee towards improving their allocations. Committee Chairman Emmanuel Udende described the current funding levels as “unfortunate” and “sad” when measured against international standards. “We will see what we can do to improve it,” he said.

It is ironic that the Federal Government expects massive recoveries from the war on corruption while failing to provide the basic operational funds needed to achieve them. In reality, the ICPC and EFCC are not just fighting corruption; they are also struggling against institutional neglect.