In a strategic move to protect its business, Dangote Petroleum Refinery and Petrochemicals FZE, has initiated a lawsuit a the Federal High Court in Abuja, seeking to nullify import licenses the Nigeria National Petroleum Corporation Limited (NNPC) and six others secured to import refined petroleum products into the country.

The plaintiff, in the suit, marked: FHC/ABJ/CS/1324/2024, is querying the propriety of the license that was issued to the defendants to bring refined petroleum products into the country when there is no shortfall in its production.

Other defendants in the suit are the Nigeria Midstream and Downstream Petroleum Regulatory Authority, NMDPRA, AYM Shafa Limited, A. A. Rano Limited, T. Time Petroleum Limited, 2015 Petroleum Limited as well as Matrix Petroleum Services Limited.

The plaintiff is also praying the court to award N100billion in damages against the NMDPRA for allegedly continuing to issue import licenses to NNPCL and the other defendants for the import of petroleum products such as Automotive Gas Oil (AGO) and Jet Fuel (aviation turbine fuel) into Nigeria.

It told the court that the licences were issued to the defendants, “despite the production of AGO and Jet-A1 that exceeds the current daily consumption of petroleum products in Nigeria by the Dangote Refinery.”

Specifically, Dangote Refinery, among other things, applied for an order of injunction, restraining the 1st defendant (NMDPRA) from further issuing and/or renewing import licenses to the 2nd to 7th defendants or other companies for the purpose of importing petroleum products.

It further sought general damages in the sum of N100bn against the 1st defendant, as well as an order of court directing the 1st defendant to seal off all tank farms, storage facilities, warehouses, and stations used by the defendants for the storage of all refined petroleum products imported into Nigeria.

Other reliefs the plaintiff prayed for, included, “a declaration that by the provisions of Section 8(1) of the Nigerian Export Processing Zone Act (NEPZA), Sections 23(h) and 55(1) of the Companies Income Tax Act (CIT Act), Paragraph 6 of the Second Schedule to the CIT Act, Regulation 54(2)(a)(i) of the Dangote Industries Free Zone Regulation 2020, and the Finance Act, the plaintiff, being an entity duly registered as a Free-Zone Enterprise, is exempted from all federal, state, and local government taxes, levies, and other rates.

“A declaration that it is against the NEPZA Act, CIT Act, Finance Act, and Dangote Industries Free Zone Regulation 2020, as well as legislative intent, for the 1st Defendant to impose or threaten to impose on the plaintiff an additional financial obligation of a 0.5% levy meant for off-takers of petroleum products directly and an additional 0.5% wholesale levy in favor of the Midstream Downstream Gas Infrastructure Fund (MDGIF).

“An order of mandatory injunction directing the 1st Defendant to withdraw immediately all import licenses issued to the 2nd-7th defendants and other companies other than the plaintiff and other local refineries for the purpose of importing refined petroleum products into Nigeria.”

Likewise, “an order of injunction restraining the 1st Defendant from imposing and demanding a 0.5% levy meant for off-takers of petroleum products directly and an additional 0.5% wholesale levy in favor of MDGIF or any other levy or sum against the plaintiff.”

According to the plaintiff, NMDPRA acted in breach of Sections 317(8) and (9) of the Petroleum Industry Act by issuing licenses for the importation of petroleum products to the defendants.

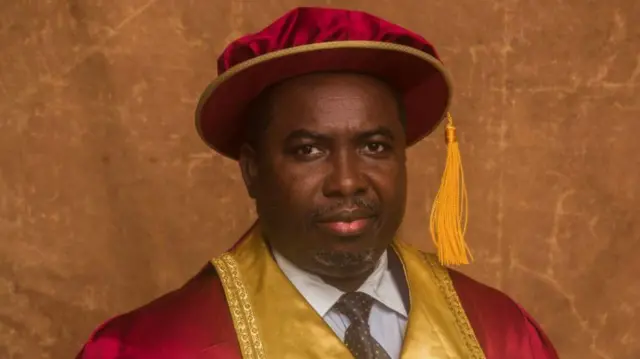

In the processes it filed through a team of lawyers led by Mr. Ogwu Onoja, SAN, the plaintiff, such licenses ought to be issued only when there is a shortfall of petroleum products in the country.

It urged the court to declare that NMDPRA is in violation of its statutory responsibilities under the Petroleum Industry Act (PIA) for not encouraging local refineries such as the one owned by the plaintiff.

In an affidavit deposed to by the Group General Manager of Government and Strategic Relations at Dangote Refinery, Ahmed Hashem, he told the court that the import licenses granted to other companies by NMDPRA for the importation of AGO and Jet-A1, are crippling the plaintiff’s business which it committed substantial financial resources in billions of US dollars.

He averred that the plaintiff’s products are largely left unpatronized due to actions of NMDPRA.

More so, the deponent told the court that NMDPRA has threatened to impose and demand a 0.5% levy on the plaintiff on wholesales and off-takers, as well as another 0.5% levy on wholesales to the Midstream and Downstream Gas Infrastructure Fund (MDGIF) via a letter dated June 10, 2024, contrary to statutory provisions that limit the implementation of levies on transactions within Free Zones.

He alleged a grand conspiracy and concerted effort by International Oil Companies and interests, in conjunction with the defendants, who are unhappy that Nigeria has an indigenous refinery ready to solve the lingering energy crisis and save the economy.

“The intervention of the Honourable Court has become necessary in order to stem the incessant violation of statutory provisions by the 1st Defendant in favor of other entities such as the 2nd to 7th defendants,” the plaintiff added.

Meanwhile, there were indications that the matter may not be heard by the court as a member of the plaintiff’s legal team, Mr. George Ibrahim, SAN, notified the court on Monday that efforts to amicably resolve the issue, were afoot.

He said the defendants had indicated their intention to explore an out-of-court settlement.

Consequently, Justice Inyang Ekwo adjourned the matter till January 20, 2025, for report of settlement.