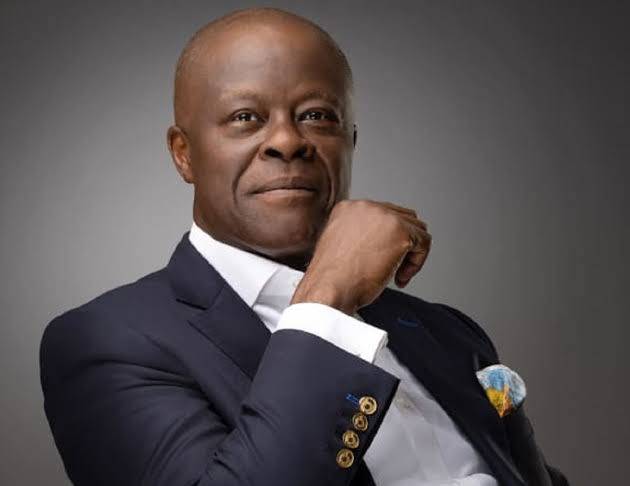

Adebayo Olawale Edun, Finance Minister of Nigeria has pointed out that up to $6.8 billion of overdue forward payments in the foreign exchange market was responsible for the slide in the naira and when addressed very soon, the local currency will regain its stabilise. This is according to Bloomberg.

The minister pointed out that once this backlog is cleared the naira will become stronger and “pave the way for additional foreign exchange flows.”

Sadly, the Naira in recent days has witnessed serious drop in value. As at Thursday in the parallel market, it was approaching the 1000 naira per dollar mark. Most experts believe this happened because the apex bank didn’t provide enough dollars for the market.

“The issue we have now is that the market is not liquid enough,” Edun, an erudite economist/banker who accompanied President Bola Tinubu to New York for the United Nations General Assembly, said in a recent interview there.

He further stated: “We are committed to encouraging liquidity based on reforms that have been made at the moment, on the fiscal side and the monetary side. And together with the restoration of trust and confidence, we think the FX flows will return.”

Nigeria’s central bank had to reschedule indefinitely a meeting slated for September 25–26 because the apex bank is waiting for the resumption of their new governor, Olayemi Cardoso, who used to work at Citigroup.

So far, the acting governor and four deputy governors have resigned thereby creating a huge gap in taking important decisions.

The nation’s finance ministry’s helmsman sure knows what he’s doing when he said: “The commitment is to maintain the existing reforms and improving them. Improving the FX market further so the gap narrows.

“Looking at all options for boosting supply so the one-way bet of speculators that we are seeing at the moment is reversed,” he concluded.

Source: Bloomberg