With favourable regulations and policies, digital channels and resilient communities, Nigeria is expected to witness an increase in remittances, surpassing foreign direct investment, WorldRemit has said.

The rise in inflow is hinged on a moderate rebound in economic growth as well as the fiscal position of the government.

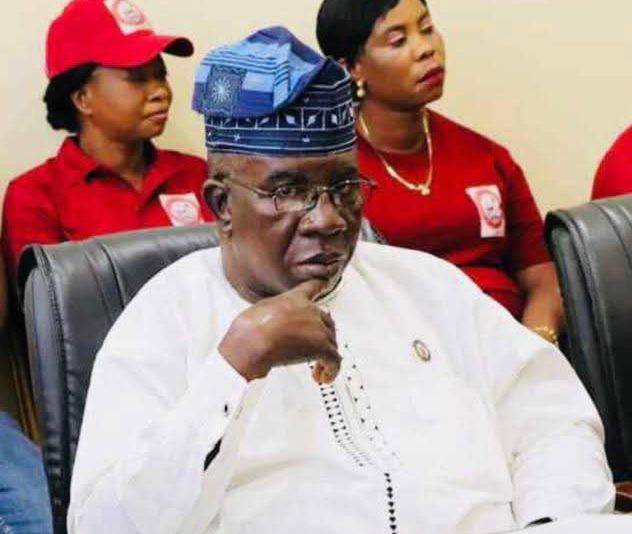

Nigeria’s Country Director, WorldRemit, Gbenga Okejimi, while identifying three key trends driving remittance growth in the country, stated that favourable regulations and policies will be critical to sustaining improved inflow in 2022.

He said the pandemic outbreak caused a decline in remittances to Nigeria by 27.7 per cent, representing a significant decline for sub-Saharan Africa because Nigeria accounts for almost half of remittances inflows in the region.

However, he noted that the growth projection was a result of the favourable policies and regulations that the Central Bank Of Nigeria (CBN) has since instituted.

According to him, the CBN Naira-4-dollar scheme, directives allowing recipients to receive funds in dollars and automatic opening of domiciliary bank accounts has been instrumental to this projection.

These regulations, he said, have encouraged Nigerians in the diaspora to send money through official channels, meaning funds previously sent by Nigerians through unofficial means can now be tracked. The regular stakeholder engagements between the regulators and providers have also encouraged innovative solutions such as seamless API integration and USD availability among others.

Okejimi said digital remittance channels are a game-changer in the cross border payment industry. In the past, people in the diaspora communities had to travel long distances to send money back home and likewise for recipients who needed to access the funds. However, digital financial services such as those provided by WorldRemit, have disrupted the industry.

He recalled that in 2020, digital technology was a vital element that prevented a total shutdown of economies and today it continues to drive the growth of remittances, enabling almost-instant receipt of funds directly as bank transfers or cash pick-up. Therefore, he said continued investments and support for innovation in international digital money transfer will increase remittance growth into the country.

He said the Federal Government expects that the e-Naira will aid remittances inflow in other technological innovation news. As regulation around this takes form and usage deepens in Nigeria, it will be interesting to see how the digital currency will shape trends.

He noted that one of the main reasons Nigerians migrate is to make a living while supporting family and communities at home to access better living conditions. The pandemic led to a loss of jobs and income, limiting the amount of money sent back to home countries. However, 2021 brought renewed hope as economies began to reopen and rebound, resulting in the ability of people to recover quickly. Resilient communities breed resilient people and are an essential element for remittance growth.