The Central Bank of Nigeria (CBN) has asserted that the current exchange rate for the naira does not reflect the real value of the local currency.

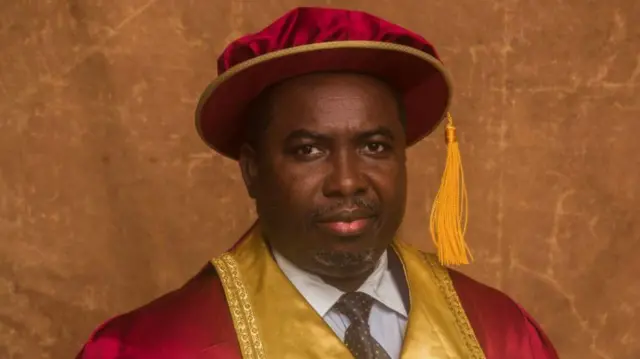

CBN Governor, Olayemi Cardoso, said this on Friday at the 59th Bankers Night organised by the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos.

Theliberationnews observes that the naira exchanges at N1,720 to dollar at the parallel market, and below N1,663 to dollar at the official window.

According to Cardoso, the current US dollar exchange rate reflects the price that the most desperate buyers are willing to pay, and this, in the apex bank’s view, does not represent the true market value of the naira.

The CBN boss said the apex bank expects that the introduction of the electronic marketing system will correct these distortions by enhancing price discovery process for the naira.

Additionally, he stated that the move will significantly boost the Central Bank’s oversight and integration capabilities, ensuring a more stable and transparent foreign exchange market.

He said the exchange rate has since June been relatively stable. He also refuted disinformation circulating about a supposed demand supply gap in the FX market, which he said was truly unnecessary.

Cardoso also stated that an FX market defined solely by when and how the Central Bank buys or sells dollars is inadequate for the needs of a dynamic economy like Nigeria’s.

“Now is the time for banks to step up to their intermediation and market making responsibilities providing customers with the right solutions to run their businesses and manage risk effectively, ” he said.

Speaking on interest rate hike, he said the interest rate cut will commence once inflation begins so show signs of decline.

He said that inflation has shown signs of decline, and that the apex bank will take steps in 2025 to ensure that inflation decline is achieved.

The apex bank boss also said the CBN will begin to sanction banks for poor service quality, and failure to load cash at Automated Teller Machine (ATM) points.

He said spot checks on banks will commence on December 1, 2025,and any bank found not meeting expectations, will be punished.

He said banks have been fined N29 billion for regulatory breaches, and the apex bank will continue to ensure compliance by the financial institutions.

Cardoso said the market has also supported over $9 billion in capital outflows over the past year as investors were able to freely repatriate capital and dividends without the need to wait for several months as experienced in the past.

“We anticipate more diaspora remittances in the coming year with a target of $1 billion monthly inflows from the diaspora, ” he said.

He said that improving transparency, and strengthening the Central Bank’s credibility and public trust in policies enable businesses and investors to plan, and reassures households that monetary decisions are made in their interests.

It also ensures accountability through open communication and constructive feedback.

“And I must say at this point that a good number of the things that we have done in the Central Bank over the past year have come as a result of dialogue, listening to the people,” he stated.

He said the apex bank’s commitment to openness extends beyond data reporting. It fosters an inclusive dialogue with all Nigerians, providing the tools to engage in economic decisions and build a resilient and informed society.

“As previously noted, the Central Bank’s return to orthodox monetary policy means that we will refrain from direct intervention in development finance initiatives that said, I am pleased to report that as of October 2024, nearly N1 trillion has been recovered or repaid under previous development finance program, thanks to the enhanced monitoring,” he said.

Cardoso said that in the foreign exchange market, the CBN faced a backlog of over $7 billion in unfulfilled commitments and a fragmented FX regime characterized by multiple forex rates, which had encouraged arbitrage opportunities.

This regime stifled much needed foreign investment, and led to the depletion of our external reserves which fell to $33.22 billion in December 2023.

”It must also be understood that the cost of the FX subsidy regime is estimated to far exceed that of fuel subsidies. In 2022 alone, the potential revenue lost due to a less flexible FX regime was approximately N6.2 trillion, compared to N4.5 trillion from fuel subsidies, ” Cardoso said.