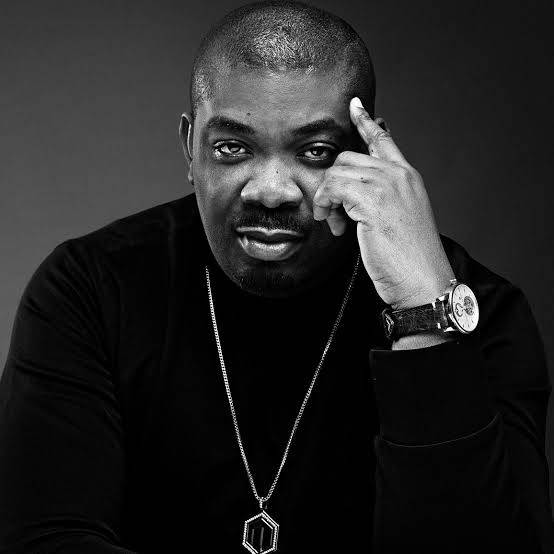

Aliko Dangote, the Nigerian industrial magnate and chairman of the Dangote Group, has regained his title as Africa’s richest man, overtaking South African billionaire Johan Rupert.

According to the latest Forbes data, Dangote’s wealth stands at $11.7 billion, narrowly surpassing Rupert’s net worth, which has declined to $10.8 billion.

This shift marks the restoration of Dangote’s 12-year reign as the continent’s wealthiest individual, a title he briefly lost to Rupert in August 2024.

The Bloomberg Billionaires Index also corroborates this trend, placing Dangote’s fortune at $13.3 billion, marginally ahead of Rupert’s $13.2 billion.

This slight difference, though not as significant as earlier valuations, reaffirms Dangote’s lead. Just two weeks ago, the gap between the two tycoons’ net worth was reported to be approximately $1 billion, with Rupert momentarily holding the top spot.

Rupert, the founder and chairman of the Swiss luxury goods company Richemont, which owns brands such as Cartier and Montblanc, experienced a decline in his wealth following fluctuations in luxury market demand and currency pressures.

Meanwhile, Dangote’s financial standing has remained relatively stable, allowing him to reclaim his position as Africa’s wealthiest figure.

● Dangote’s Ambitious Growth Strategy

Aliko Dangote, renowned for his business acumen, has not rested on his oars. The Dangote Group, one of Africa’s largest conglomerates with interests spanning cement, sugar, salt, and oil refining, has set its sights on further growth.

In a recent presentation during a media tour of the Dangote Refinery, the billionaire outlined plans to increase the group’s revenues to an ambitious $30 billion by 2025.

Central to this strategy is a significant shift in the group’s foreign exchange (FX) operations.

Dangote aims for the conglomerate to become Africa’s largest provider of foreign exchange, with the goal of reducing dependence on the Central Bank of Nigeria (CBN) for FX sourcing.

This move would not only bolster the group’s resilience but also enhance its competitiveness on the global stage.

Dangote further revealed plans to dramatically reduce the group’s reliance on the Nigerian cement market, which currently accounts for 75% of its business, down to 15%. Additionally, he projected a diversification of revenue sources, with 50% of EBITDA expected to come from foreign markets.

He also emphasized that 90% of the group’s future revenue would be generated in hard currency, underlining its focus on international expansion and export-driven growth.

For the Dangote Group, the highly anticipated Dangote Refinery was announced make its first shipment of Premium Motor Spirit (PMS), commonly known as petrol on Tuesday, September 3, marking a critical moment in Nigeria’s energy sector, as the refinery, with a capacity of 650,000 barrels per day, enters commercial production.

Having successfully completed its testing phase, the refinery is expected to play a key role in reducing Nigeria’s dependence on imported petroleum products.

The completion and operationalization of the refinery have drawn praise from several high-profile figures, including Nigerian billionaire and oil magnate, Femi Otedola.

The project is seen as a game changer for both the Dangote Group and Nigeria, potentially transforming the nation’s oil industry and positioning it as a net exporter of refined petroleum products.

Nairametrics