By Opeoluwa Dapo-Thomas

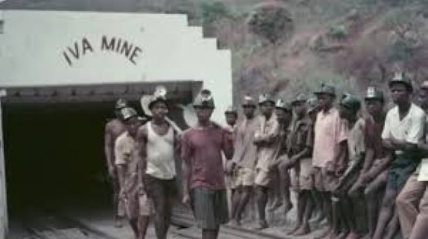

In the 1800s and early 1900s when slavery thrived, Africans were forced on ships to Europe and the Caribbean. Paradoxically, it may appear that if these ships were to return, we may see a very large number of Nigerians who would prefer to live as slaves than remain here in Nigeria.

It is nothing short of concerning. A 2021 study by African Polling revealed that 7 out of 10 Nigerians planned to relocate if the opportunity presents itself. Another stat from PEW Research toes the same path.

About 45% of Nigerians say they plan to leave the country in the next five years. This is the highest in any African country, followed by 24% of Tunisians who plan to relocate in five years.

Unfortunately, the cost of relocating abroad is on the high side. With the recent fall of the Naira against the dollar, expenses that were classified as minor like Visa acquisition, IELTS and TOEFL certifications have become more expensive.

According to the British Council, from September 2023, the new prices for IELTS Academic and General Training would be N107,500, N116,000 for UK Visas and Immigration and N104,000 for Life Skills.

Erstwhile, the prices for these ranged between N60,000 to N90,000. Flight ticket prices are also on the rise. According to the Nigerian Bureau of Statistics NBS, Nigerians paid 34.06% more for flights in June 2023 than they did in June of the previous year.

With all of these hikes here and there, how then are Nigerians able to ‘seemingly’ relocate with ‘ease’? How are more and more people able to make the move abroad?

The economic situation at home

To paint the economic situation at home on a good canvas with near perfect strokes, this stat from Statista may just do the job. In 2022, 88.4 million Nigerians live in abject poverty i.e less than $1.90 per day.

In common terms, close to half of the entire Nigerian populace are struggling to survive daily. They live from hand to mouth and hope for a miracle for the next meal on the table.

For context, the price for IELTS Academic and General Training is more than three times the country’s minimum wage which stands at N30,000 per month.

A Nigerian online travel agency Naija Japa puts the normal travel cost for visitors to the UK at N2,318,000 and students at N2,102,271. But in 2021, the Nigerian Deposit and Insurance Corporation NDIC revealed that 99.4% of Nigerians do not have up to N500,000 in their bank accounts.

If only 0.6% of Nigerians have N500,000(which is only about one-fourth the average travel expenses) in their accounts, how then are more and more Nigerians able to afford relocating abroad?

Is there something they are not telling everyone? The answer lies in the selling of properties.

Making the move by all means possible

The late Sound Sultan in his 2006 single ‘Area’, spoke about the struggles people undertake to make the move abroad.

One line “remember Nnamdi sell him car make you take go America” underscores the fact that many Nigerians who travel abroad do so by literally impoverishing themselves and others.

According to a July Business Day article, more and more Nigerians are selling off their properties, closing their businesses and making the hopeful move for greener pastures abroad.

In some cases, this risky gamble pay off but in most, the hopefuls are left stranded with their dreams of a better life dashed.

Almost every Nigerian knows that one person who travelled abroad and in a few years ‘made it’. The few stories like these paint a very lopsided view on what is truly obtainable and the prospects of fitting in and thriving abroad.

According to the US Bureau of Labor Statistics, foreigners earn only 86.9% of what their native counterparts earn per year. Nigerians who make the move soon realize that they were told half baked stories.

The pay and cost of living was very different from the utopia they thought it was. The competition for jobs is a far cry from what they were told.

Weren’t store owners, factory keepers and hospitals supposed to knock on your doors and beg you to work for them?

They soon realize that several immigrants also made the move too and especially for very unskilled Nigerians, the search for a high paying job becomes increasingly frustrating.

Making the move

Understandably, it is easier to make ends meet abroad than it is here in Nigeria. For example, inflation in the US stands at 3.2%, in the UK inflation is just 6.4%, Irish July Consumer Price Index CPI puts inflation at 5.8% while Nigerian inflation for July hit double figure of 24.08%.

However, it would be very unwise to abandon ship and attempt to start over in a foreign country especially if you are not very skilled.

Skilled professionals like doctors, accountants, engineers etc. may easily blend in and get high paying jobs. The same cannot be said for the unskilled workers who make the desperate move abroad.

Dapo-Thomas is a British-Nigerian international financial analyst and can be reached on opeoluwadapothomas@gmail.com