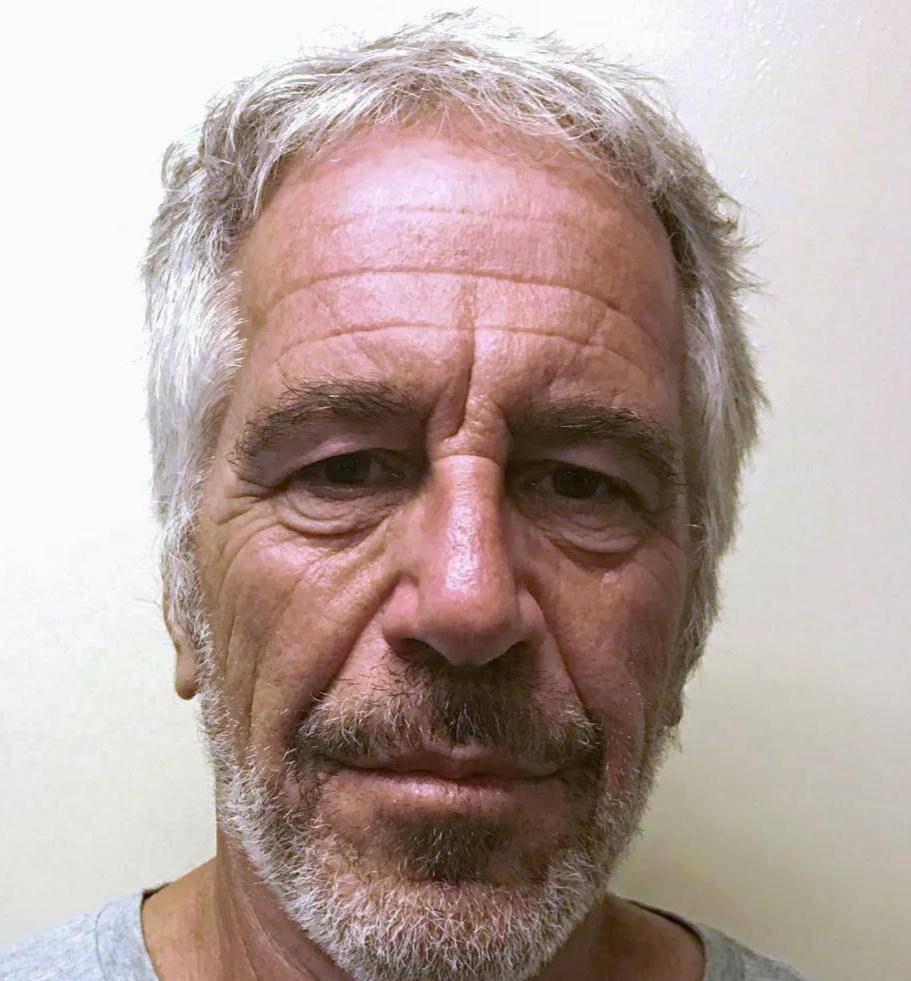

Sanusi Lamido Sanusi, former Governor of the Central Bank of Nigeria (CBN) has given an insight into to the new design of the proposed 200, 500 and 1000 naira notes.

This was as he reaffirmed that plans to introduce the N5,000 note is still being considered.

The apex bank under Sanusi’s leadership in 2012 proposed a 500 Naira note which was strongly rejected.

Speaking on the designs for the proposed new Naira notes Sanusi confirmed that it will all carry Arabic inscriptions, as against rumour flying around that the Apex bank planned to remove the Arabic e texts.

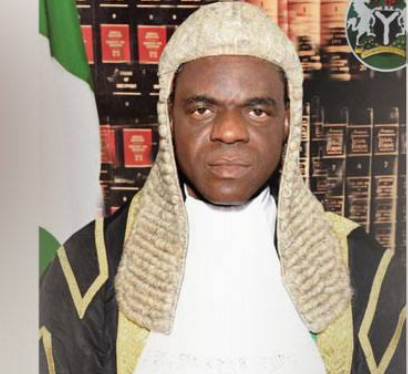

The former CBN Governor, in a short sermon shared via his social media platforms, explained that he got the assurance from the CBN Governor Godwin Emefiele, who described the rumoured removal of the Arabic inscription on the Naira notes as baseless.

During the sermon, he recalled how attempt by the CBN to introduce N5,000 note was resisted, stressing “considering the quantum of cash Nigerians carry, the issue is something that can not be avoided in future”.

In 2012, Sanusi as CBN Governor, while justifying the introduction of higher denominations said: “inflation in Nigeria is a monetary phenomenon. In some countries such as Singapore, Germany and Japan, the highest denominations are 10,000 SGD, 500Euro and Yen 10,000, respectively.

“These denominations have relatively high dollar equivalent. The levels of inflation are, however, low at 2.8, 1.1 and -0.7, respectively as at 2010.

“We believe that the introduction of a higher bill would complement the bank’s cashless policy as it would substantially reduce the volume of currency in circulation, particularly in the long term.”

The former CBN Governor, who is the spiritual leader of the Tijanniyah Sufi order of Nigeria, urged islamic scholars to always “ask questions on issues of the economy from relevant authorities”.

Mallam Sanusi Lamido however said his video was “just to clarify and debunk rumours of the removal of the Arabic inscriptions” adding that If he had issues with the bank’s policy or timing, he will discuss with the relevant authorities of the apex bank and not publicly”.