Analysts at the Parthian Group are bullish about the country’s market, saying there are abundant opportunities individual and institutional investors can leverage to increase capital gains and dividend incomes despite the uncertainty.

They urged investors to closely watch prospects in building materials, emerging payment system banks (PSBs), possible mergers and acquisitions for rare investment opportunities that could emerge big deals as the year progresses.

The consultants, who spoke at an investment clinic and an interactive session, last week, said Nigeria’s investment market holds great opportunities for huge capital gain and dividend incomes.

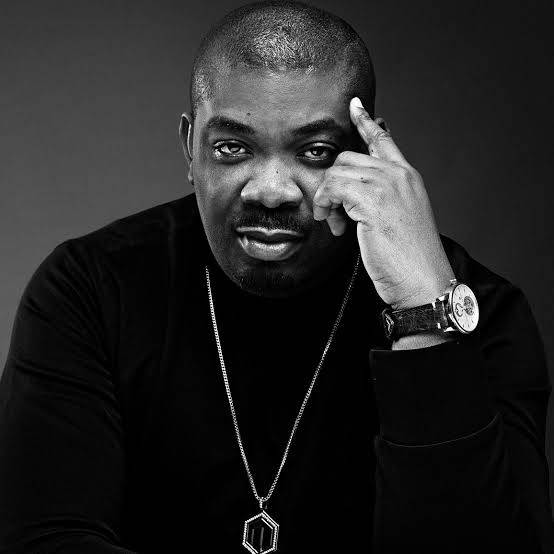

Speaking at the clinic, the Group Managing Director/Chief Executive Officer of the organisation, Oluseye Olusoga, said interest rate and inflation dynamics, as well as the political risk, would go a long way to shape the investment market this year.

He, however, said the usual fear during the pre-election year that the exit of foreign investors would have a negative effect on the performance of the equity market would be minimal this time as the market is now dominated by local players.

Olusoga said the year would witness increasing competition in the banking industry as PSBs are expected to take off, which is expected to unsettle the conventional banks. He said most of the banks are aware of the threat of the shadow banks, hence they are throwing their hats into financial technology (fintech) with some opening subsidiaries to focus on the segment.

He noted that the challenges faced by foreign investors in terms of “capital repatriation” and the haircut they have had to take as a result of currency volatility made the market unattractive to foreigners.

Chief Strategist, Parthian Securities Limited, Ahmed Banu, said pre-election years hurt the market, historically. He, however, said certain sectors still hold great opportunities following the unique prospects in those areas.

According to him, an increase in infrastructure spending would benefit building material sectors positively. Thus, he urged investors to watch the sector for investment opportunities.

MTN and Airtel secured PSB provisional licences last year. When they eventually take off, Banu said, will not only pose a serious threat to the banks but would also begin to share the huge opportunities in the banking sector.

He added that the telecommunication players would sustain their attraction as they leverage opportunities in PSBs to expand their revenue base.

The investment advisor noted that the equity market might defy impacts of political uncertainty as “there is a positive correlation between the performance of equities and oil prices.” If crude prices continued to increase, he said, the market may close the year on a positive note.

Senior Vice President of the group in charge of the global market, Ola Oladele, said the company’s i-invest app offered Nigerians an opportunity to navigate the investment options. According to her, the app seeks to democratise opportunities in the capital market, enabling investors to explore available options any time of the day.