Experts from BMI, a Fitch Solutions company, have predicted that in not-too-distanced time, the exchange rate for the naira will reach N1,993 to one US dollar.

This sharp decline is expected to have a significant impact on Nigeria’s pharmaceutical industry, especially the importation of medical devices.

As contained in a report titled “Weak Naira and Structural Challenges to Constrain Nigeria’s Medical Devices Market Growth,” the company highlighted that despite hopes for an economic recovery, Nigeria’s medical device market will continue to face difficulties. The weakening naira will increase the cost of importing medical devices and reduce the purchasing power of consumers, making essential healthcare technologies less affordable.

The report highlighted that Nigeria depends majorly on medical device imports, with more than 95% of the devices used in the country being brought in from abroad. As the naira weakens, the price of these imported devices will keep rising, making it harder for both the health system and patients to afford them. This will particularly affect high-cost devices like diagnostic tools, orthopaedic products, and dental equipment.

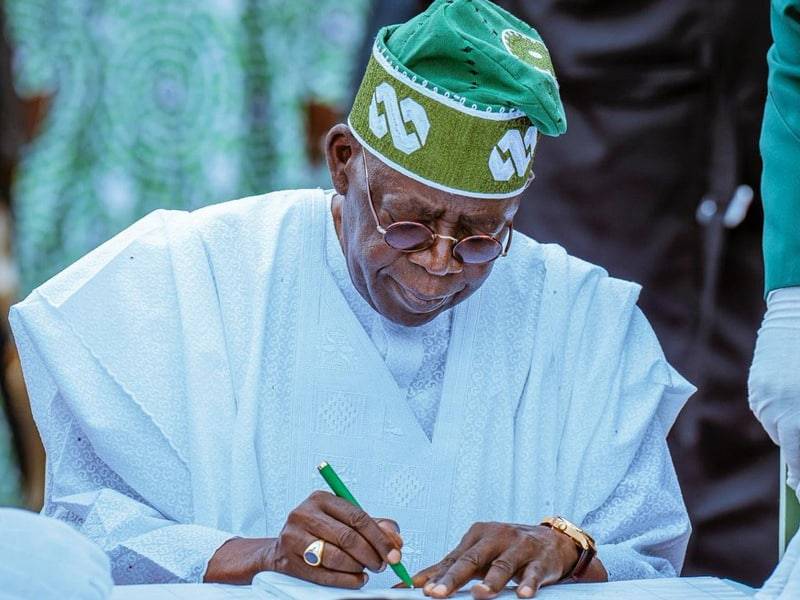

While the Nigerian government has tried to help, including a recent executive order by President Bola Tinubu to cut medical service costs, the report still sees many challenges for the industry. For example, the order to remove tariffs, excise duties, and VAT on certain medical equipment aims to reduce local production costs, but the effects are not expected to be immediate.

The Fitch Solutions company predicts that Nigeria’s medical devices market will reach a value of N171.1 billion or $344.7 million by 2028. They expect demand to remain high due to Nigeria’s large population and the double burden of chronic and communicable diseases. However, the company also noted that despite these efforts, the market will face challenges such as high inflation, weak foreign investment, and tighter monetary policies.

A troubling example of these challenges is the decision by Turkey’s Jubilee Syringe Manufacturing (JSM) to halt operations in Nigeria, citing unforeseen circumstances. This follows similar closures by other companies, such as Sanofi and GlaxoSmithKline, which stopped manufacturing in Nigeria due to the tough business environment.

The report also pointed out several obstacles for local manufacturing of medical devices in Nigeria. These include a shortage of skilled workers, poor access to modern technology, and inadequate infrastructure. Additionally, regulatory hurdles, slow approval processes, and bureaucratic delays further discourage investment in the sector.

Fitch believes that the African Medicines Agency (AMA) could help improve the regulatory landscape for medical products in Africa in the long run, but this will only happen if the agency is fully implemented. However, the lack of reliable infrastructure, including consistent electricity and transportation, continues to complicate manufacturing and distribution efforts.

In conclusion, despite government efforts to support local production, the report suggests that these structural and economic challenges will limit the growth of Nigeria’s medical device sector.